“If something cannot go on forever, it will stop.” — Herb Stein, chairman of the Council of Economic Advisers under President Nixon and President Ford

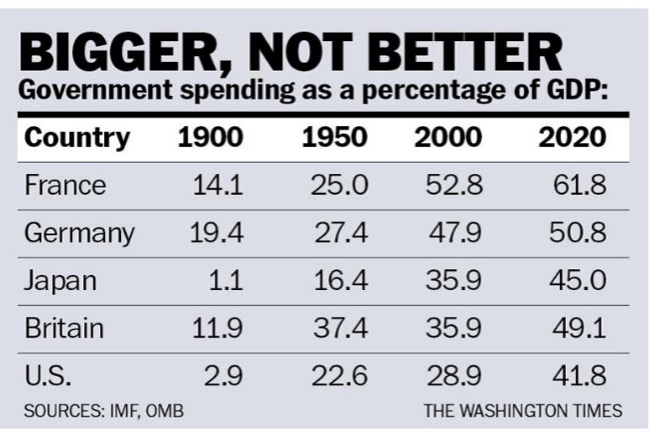

The socialists and communists explicitly say they want bigger government, while most free-market and libertarian-leaning people claim they want smaller government. Small government had been the standard from the American founding until World War I. In 1900, the U.S. had a total (federal, state, and local) government sector equaling about 2.9% of GDP. Japan had 1.1% of GDP, the U.K. was at 11.9%, France at 14.1%, and Germany at 19.4%.

Over the decades, particularly from the Great Depression in the 1930s, governments have grown bigger almost everywhere. For 2020, the Office of Management and Budget estimates that total government spending was 41.8% of GDP in the U.S. The International Monetary Fund’s estimates are 45.0% for Japan, 49.1% for the U.K., 50.8% for Germany, and a whopping 61.8% for France.

Real data on big government spending

There have been several academic studies over the last half-century to determine the optimum size of government. Most of the studies conclude that if the government exceeds a range of approximately 15% to 30% of GDP, economic performance declines, and civil liberties are diminished. All of the major economies now have government sectors far higher than optimum.

Noted Chapman University professor Mark Skousen recently wrote in Skousen CAFÉ that in the U.S., “Despite campaign promises, government (federal, state, and local) spending has increased from 35% to nearly 50% of GDP over the past 25 years” and that economists have known for decades that the size of government and economic growth tend to have an inverse relationship.

A new study by Daniel Mitchell, chairman of the Freedom and Prosperity Foundation, and Robert O’Quinn, former chief economist of the Department of Labor, shows that President Biden’s proposed Build Back Better act will significantly expand the welfare state, increasing the “spending burden by 1.9% of GDP, which will reduce the economy’s growth rate by about 0.2% each year.”

Why does socialism fail?

There are natural limits to how big government can get. Even the socialists and communists could not stamp out all private enterprises. Government, being a monopoly, engages in those behaviors that monopolies exhibit — inefficiencies, misallocation of assets, favoritism, poor service, a failure to innovate and so forth.

Without a vibrant market economy, socialists and communists do not know how to price anything. Prices allocate scarce resources and motivate future production. The famous 20th-century Austrian economists, Hayek, von Mises and others, provided logical proof of how a socialist economy could not function without market-determined reference prices.

A major reason the communist/socialist economies of Eastern Europe and the Soviet Union collapsed was that they failed to innovate and increase productivity. During the later years of Eastern European socialism, the black or underground economies were growing, rather than diminishing, as the state-owned enterprises failed to provide the goods and services the people were demanding.

The Swedes provide an interesting case of the rapid growth of the government sector after 1945 until 1995 when government spending peaked out at about 70% of GDP. It was apparent to most Swedes that the “welfare state” was not working as advertised. A consensus developed to downsize government to approximately 50% of GDP, which has resulted in significantly improved economic performance.

Debt and inflation

In most countries, the increases in government spending are more popular than the increases in taxes to pay for all of the new and expanded programs. As a result, more and more government spending is paid for through the issuance of government debt.

Eventually, the growing debt burden causes such a rise in interest payments that government increasingly borrows to pay the previous debt. At some point, a fiscal death spiral begins where the interest payments increasingly eat away at the government programs until the system collapses.

Greece is a recent example of a country living beyond its means for so long that it could no longer borrow (or inflate its currency because it uses the euro), and hence living standards have been falling sharply for much of the last decade.

The U.S. and many other countries are beginning to exhibit the same problem with inflation (caused by excessive borrowing) rising faster than incomes, causing real living standards to fall.

This process is likely to accelerate, and as the U.S. dollar becomes less and less as a store of value. People will increasingly look for alternative currencies. Hence the popularity of Bitcoin, “stable coins” and real asset-backed physical-digital coins, such as those backed by gold, silver or aluminum.

The hyperinflations in the former socialist countries wiped out most of their debt, allowing them to start over. The bad news is most of the major economic powers are in for a painful correction, much like the Greeks have been experiencing. But once much of the real debt (through inflation) and wasteful government programs are eliminated, as they were in Poland and Estonia, for example, prosperity will return.

-Article written by Richard W. Rahn. Richard was Chief Economist of the U.S. Chamber of Commerce (the world’s largest business federation), an advisor to the New York Mercantile Exchange, the first non-Caymanian member of the Cayman Islands Monetary Authority. He is the author of “The End of Money: and the Struggle for Financial Privacy” and of more than a thousand published articles. He has testified before the U.S. Congress on economic issues more than 75 times. You can also find Richard Rahn on Twitter: https://twitter.com/RichardWRahn

This article first appeared in The Washington Times LLC. Copyright © 2021 The Washington Times LLC. All rights reserved.