By Richard Rahn, Co-Founder & Chairman @ Luminium Coin – Jan 21, 2022

This past week, the Bureau of Labor Statistics reported that consumer prices rose by 7% during this past year, the highest in 40 years. The dollar is also falling against other global reserve assets. Most of the world’s major commodities are priced in dollars, and when the dollar falls, these prices for U.S. consumers are likely to rise, meaning that inflation is likely to persist.

Inflation refers to a general progressive increase in prices of goods and services, whereby each currency unit buys fewer goods and services, causing a reduction in the purchasing power of the money. For thousands of years, governments — including the ancient Romans — debased their currencies, most often by reducing the silver and gold content of the government-issued coins and substituting cheaper metals like copper.

The golden age of currency stability began in 1717, when Sir Isaac Newton, master of the U.K. mint, fixed the British currency to gold. As the superpower of the time, the British pound became the world reserve currency — like the U.S. dollar today — and most major countries also adopted the gold standard by 1870. The world economy became globalized for the first time with a common currency (gold), which eliminated exchange rate risk, and there was no persistent inflation.

In fact, more years had a small deflation rather than inflation — because the world economy was growing faster than the global increase in the supply of gold. This international monetary arrangement lasted until the outbreak of the First World War in 1914. The major combatants could not finance the necessary increase in spending for arms under the gold standard — so fiat money issued by central banks began its rule with unlimited debt. Now, more than a hundred years later, the massive amount of debt is likely to sink the major economies, including the U.S.

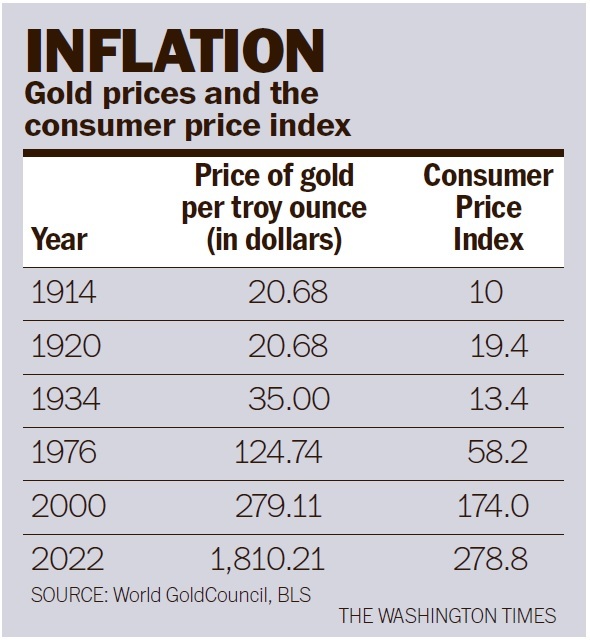

As can be seen in the accompanying table, the price of gold is roughly 90 times higher than it was in 1914 (the beginning of the Federal Reserve), and the CPI is approximately 28 times higher than it was in 1914. President Franklin D. Roosevelt increased the price of gold in 1934 and prohibited private ownership of it except for some jewelry. In 1971, President Richard Nixon took the U.S. officially off the gold standard and allowed private ownership of gold by 1976. The price of gold has been very volatile since 1973.

Inflation is highly correlated with changes (after lags) in the quantity of money. The quantity of money is increasingly difficult to measure given all public and private near money substitutes and definitional and regulatory changes by government monetary policymakers. There is very good price data on basic commodities going back to 1800 or so. A bushel of wheat or corn is pretty much the same item 200 years ago as it is today. In 1800, the average family spent most of their income on food and fuel — so changes in price levels and living standards were reasonably easy to calculate.

Other than gasoline and natural gas, most families buy relatively little in the form of basic commodities. How does one calculate the change in the price of a frozen dinner to a change in the price of pork bellies? A cell phone is not just a phone, but a camera, TV, encyclopedia, clock, library, news source, advanced calculator, medical monitor, etc. How does one measure the change in price and quality of every app compared to the pre-smartphone era?

People know that they are paying considerably more than they did a year ago when they go to the grocery store and the gas station. But the actual change depends very much on each individual’s consumption patterns and income level. Over the last two years, the money supply grew by about 40% by most measures — the highest in U.S. history.

The U.S. government is running a deficit of about 7.8% of GDP — the highest in the world. The supply of new goods and services is running at a fraction of the growth in money and deficits. Where is all that money going? If it is not going to more output, it shows up as higher prices. The Fed and the fiscal authorities in the Administration and the Congress are now admitting that inflation is more than a transitory problem — but despite their new rhetoric, they are still digging the hole deeper by continuing to issue massive amounts of new debt.

I have worked in countries suffering from high and even hyperinflation. One common characteristic of the political and media leaders is self-delusion — somehow, things will get better without major reductions in government spending and monetary growth. The argument is always the same — there will be a surge in output and productivity because demand is growing, and there are “unmet needs.” It never happens.

The great Austrian economist and Nobel Laureate F.A. Hayek provided the long-run way out of the dilemma, “The Denationalization of Money” (1976). If competitive private companies can give us better automobiles and toothpaste than socialist companies, why can they not give us more useful and stable units of accounts than monopoly government money producers?

Richard W. Rahn was Chief Economist of the U.S. Chamber of Commerce (the world’s largest business federation), an advisor to the New York Mercantile Exchange, the first non-Caymanian member of the Cayman Islands Monetary Authority. He is the author of “The End of Money: and the Struggle for Financial Privacy” and of more than a thousand published articles. He has testified before the U.S. Congress on economic issues more than 75 times. You can also find Richard Rahn on Twitter: https://twitter.com/RichardWRahn

This article first appeared in The Washington Times LLC. Copyright © 2021 The Washington Times LLC. All rights reserved.